Tenants experiencing domestic and family violence (DFV)

Visit our Domestic violence in a rental property webpage to learn how to request a bond refund when exiting a tenancy due to DFV.

Update

Important: The RTA reminds customers to regularly update your passwords using strong passphrases, watch for any unauthorised online account transactions, be alert when clicking on links within emails, and follow the Australian Cyber Security Centre’s advice to protect your information and stay safe online. Learn how the RTA keeps your data safe.

You can use the RTA’s Bond Refund Web Service to request:

- a full bond refund*

- a partial bond refund, following a rent reduction (for any other type of partial bond refund, such as claiming your share of the bond, please use the paper Refund of rental bond form (Form 4)).

When everyone agrees on how the bond will be paid out, the refund can be fast tracked. If one or more parties disagree with the bond refund, they can use this Web Service to dispute the bond refund and request free Residential Tenancies Authority dispute resolution.

For the best user experience, the RTA recommends using a browser other than Internet Explorer to access RTA Web Services. Read all the information below before making your bond refund request.

*A full bond refund generally occurs at the end of the tenancy.

In a full bond refund you may either:

- refund the whole bond to the bond contributors (i.e. the parties who paid the bond – this is usually the tenants) OR

- allocate some, or all, of the bond amount to the property manager/owner, to cover expenses/claims such as damages, unpaid rent etc.

Tip: tenant/s and the property owner/manager should discuss and agree on how the bond will be paid out before lodging a refund request.

Important: Help is available for customers who are unable to use RTA Web Services or post. Please contact us if you require urgent help to submit a bond refund form. Your options will be discussed on a case-by-case basis.

Before you begin, you will need:

Tenants

- your Queensland Digital Identity (QDI) login details (follow the prompts to create a QDI when logging into RTA Web Services)

- a bond number

- the handover or vacate date (if applying for a full bond refund)

- the new weekly rent, if applying for a rent reduction refund

- unique email addresses for all tenants

- your bank account details.

Managing parties

- your QDI login details (follow the prompts to create a QDI when logging into RTA Web Services)

- your organisation’s RTA ID number (for joint lessors and organisations only, individual lessors do not require an RTA ID)

- a bond number for a current tenancy

- the new weekly rent, if applying for a rent reduction refund

- the handover or vacate date. If applying for a full bond refund, provide details of any claims on the bond

- reason and amounts of any claims on the bond

- unique email addresses for all tenants.

Note: Refunds are only paid into Australian bank accounts.

Remember: It is an offence for a person to knowingly give the RTA documents that contain false or misleading information. This applies to all forms of written communication to the RTA, not just submitting online forms. It also applies to anyone who provides information to the RTA, not just tenants/residents and property managers/owners.

By submitting information through RTA Web Services to the RTA, you affirm that, to the best of your knowledge, the information provided by you through this Web Service is accurate and truthful and you confirm that the document is not false or misleading in any material particular.

Who can submit a digital bond refund request?

Either the managing party or a bond contributor can submit a bond refund request. Bond contributors are generally tenants who have paid a share of the bond but may also be someone who has paid the bond on a tenant’s behalf.

To start the bond refund process through Web Services, you must be able to verify your digital identity through QDI.

If you can't verify your identity online through QDI, visit the Queensland Government QDI website or phone 1800 000658 for more information about other verification options and QDI support.

Alternatively, you can use the RTA's paper Refund of rental bond form (Form 4) and post it to the RTA. The RTA cannot verify your identity on behalf of QDI.

You can only submit a digital refund request if:

- you are a party to the bond (either a managing party of a bond contributor)

- you are lodging a full bond refund or a partial refund following a rent reduction (for any other type of partial bond refund, such as claiming your share of the bond, please use the paper Refund of rental bond form).

- there is not already a bond refund in progress.

Important: Tenants experiencing domestic and family violence can end their interest in a tenancy quickly and apply to the RTA to request their rental bond contribution be refunded by completing the RTA’s paper Bond refund for persons experiencing domestic and family violence (Form 4a). Tenants will also need to provide evidence (e.g. a notice to end the tenancy and a Domestic and family violence report) with their Bond refund form. Please contact the RTA for further assistance in this process (Monday - Friday, 8:30am to 5:00pm, excluding public holidays). Learn more.

Responding to a bond refund request

What is the bond refund process?

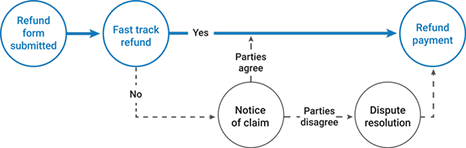

The graphic below shows the process for bond refunds.

Please note: If the managing party submits the bond refund request through Web Services, and refunds 100% of the bond to the contributors, the bond will be paid out automatically. In this circumstance, the bond contributors do not need to agree to the refund, as the managing party is not making a claim on the bond. The amounts refunded to each bond contributor must match those on the bond lodgement for the bond to be paid out automatically.

In all other situations, a Web Service bond refund will progress through the stages outlined below.

Stage one - Fast Track refunds

Once a bond refund has been submitted by either the property manager/owner or a bond contributor, all parties on the bond will be sent a Bond Refund Fast Track request via email.

All parties have 48 hours to respond to the bond refund fast track before it expires. If all parties agree to the bond within this time, the bond can be refunded within hours.

To take of advantage of the Bond Refund Fast Track you should:

- speak to the other parties and agree on how the bond will be paid out, before you submit a bond refund request

- ensure everyone listed on the bond is aware of the refund and responds to the Bond Refund Fast Track email within 48 hours.

If all parties agree during the Fast Track period, the bond will be refunded.

If one of more parties does not agree to the bond refund during the Fast Track period, the refund progresses to the Notice of claim.

Stage two - Non-Fast Track refunds and Notice of claim

The Notice of claim is sent out if:

- one or more parties has not responded to the Fast Track request within the allocated 48-hour timeframe; or

- one or more parties has disagreed with the bond refund during the Fast Track period.

When this happens, the Notice of claim will be sent out to any parties on the bond who did not agree to the bond refund during the Fast Track period. Parties who agreed with the Fast Track refund will not receive a Notice of claim.

Important: If a customer disagreed with the Bond Refund Fast Track, they must still respond to the Notice of claim if they want to dispute the bond refund. All parties have 14 clear days to respond to the Notice of claim. If no one disputes the bond refund within this time, the refund will be automatically paid out as per the original refund request.

If one or more parties disputes the bond refund Notice of claim, the bond refund progresses to the dispute stage.

Stage three - Bond Disputes

If one or more parties responds to the Notice of claim and disputes the bond refund, a hold is placed on the bond. An RTA officer will then contact all the relevant parties to start the dispute resolution process.

The RTA’s dispute resolution service is free and confidential and helps tenants and property manager/owners resolve disputes without the need for legal action. Learn more on our dispute resolution page.

If all parties reach an agreement during the dispute resolution process the RTA will allocate the relevant paperwork and the bond will be paid out.

If no agreement is reached during the dispute resolution process the RTA will issue a Notice of unresolved dispute. The bond refund dispute will then be referred to the Queensland Civil and Administrative Tribunal (QCAT). Visit the QCAT website for more information.

Helpful resources

For all customers

Find out more about how QDI works on the Queensland Government QDI website.